Decentralized Dollars for the internet.

The revolution will not be centralized. USDFI is the decentralized digital currency for decentralized finance and beyond.

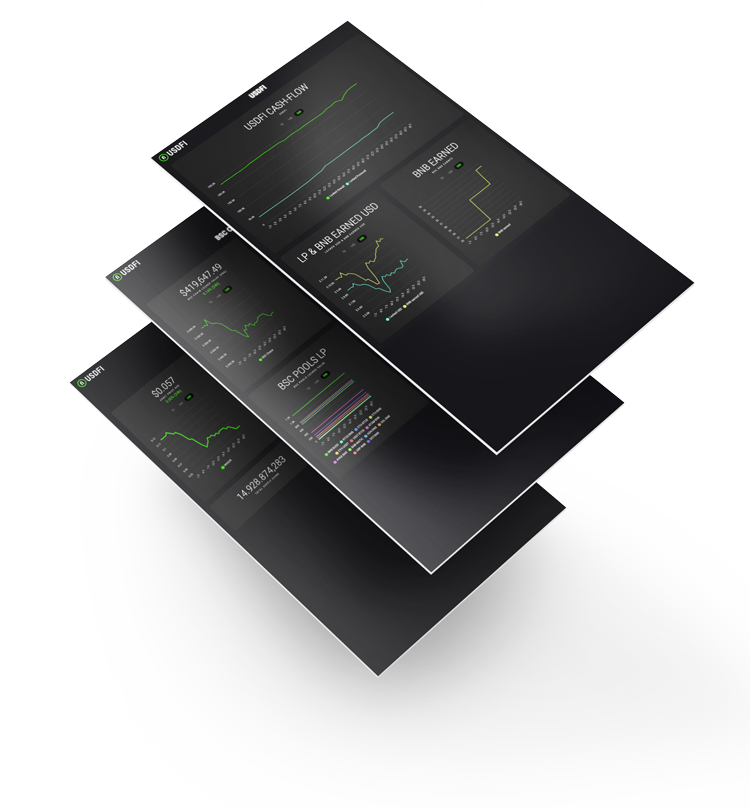

Blue-chip crypto collateral reserve. 100% transparent, real time on-chain treasury.

Defi everything.

-

-

USDFI: Tracking the price of USD.

USDFI is the only DeFi stablecoin with a crypto native, built-in ecosystem supporting a distinct DeFi stability mechanism. USDFI bootstraps TVL and adds deep liquidity to your favorite blockchain.

No human?

No problem.

USDFI’s monetary policies are fully automated across different protocols designed from the ground up to offer maximum predictability and transparency. Anti-stable by design but built to last.

metaUSD: Hello stablecoin diversification.

The most important tool to manage risk is diversification. metaUSD introduces the stablecoin ETF, offering USDFI and crypto’s most popular stablecoins like Tether, USDC, DAI or BUSD in one single token. For the first time, stablecoin risks can be diversified across architectures, issuers, stability mechanisms and blockchains.

Audit, trust and verify.

The bug stops here. All USDFI protocols are pending audit by CertiK, the leading security-focused ranking platform to analyze and monitor DeFi projects. Their highly accurate formal verification auditing reviews the code’s logic with a mathematical approach to ensure the protocols work as intended.

Milestones

USDFI launch on Polygon, Fantom & Ethereum -

USDFI structured NFTs -

USDFI launch on Polygon, Fantom & Ethereum -

USDFI structured NFTs -

USDFI launch on Polygon, Fantom & Ethereum -

USDFI structured NFTs -

USDFI launch on Polygon, Fantom & Ethereum -

USDFI structured NFTs -

- USDFI borrowing and lending

- USDFI risk management tools

- USDFI borrowing and lending

- USDFI risk management tools